Cappelle-la-Grande’s system is a living laboratory created by Paris-based energy firm Engie. The company foresees a big scale-up of hydrogen energy as the cost of electrolyzers, as well as of renewable electricity, continues to fall. If Engie is right, blending hydrogen into local gas grids could accelerate a transition from fossil to clean energy.

The company is not alone. Renewable hydrogen is central to the European Commission’s vision for achieving net-zero carbon emissions by 2050. It is also a growing focus for the continent’s industrial giants. As of next year, all new turbines for power plants made in the European Union are supposed to ship ready to burn a hydrogen–natural gas blend, and the E.U.’s manufacturers claim the turbines will be certified for 100 percent hydrogen by 2030. European steelmakers, meanwhile, are experimenting with renewable hydrogen as a substitute fuel for coal in their furnaces.

If powering economies with renewable hydrogen sounds familiar, it is. Nearly a century ago celebrated British geneticist and mathematician J.B.S. Haldane predicted a post-fossil-fuel era driven by “great power stations” pumping out hydrogen. The vision became a fascination at the dawn of this century. In 2002 futurist Jeremy Rifkin’s book The Hydrogen Economy prophesied that the gas would catalyze a new industrial revolution. Solar and wind energy would split a limitless resource—water—to create hydrogen for electricity, heating and industrial power, with benign oxygen as the by-product.

President George W. Bush, in his 2003 State of the Union address, launched a $1.2-billion research juggernaut to make fuel-cell vehicles running on hydrogen commonplace within a generation. Fuel cells in garages could be used as backup sources to power homes, too. A few months later Wired magazine published an article entitled “How Hydrogen Can Save America” by breaking dependence on dirty imported petroleum.

Immediate progress did not live up to the hype. Less expensive and rapidly improving battery-powered vehicles stole the “green car” spotlight. In 2009 the Obama administration put hydrogen work on the back burner. Obama’s first secretary of energy, physicist and Nobel laureate Steven Chu, explained that hydrogen technology simply was not ready, and fuel cells and electrolyzers might never be cost-effective.

Research did not stop, however, and even Chu now acknowledges that some hurdles are gradually being cleared. The Cappelle-la-Grande demonstration is one small project, but dozens of increasingly large, ambitious installations are getting started worldwide, especially in Europe. As the International Energy Agency noted in a recent report, “hydrogen is currently enjoying unprecedented political and business momentum, with the number of policies and projects around the world expanding rapidly.”

This time around it is the push to decarbonize the electric grid and heavy industry—not transportation—that is driving interest in hydrogen. “Everyone in the energy-modeling community is thinking very seriously about deep decarbonization,” says Tom Brown, who leads an energy-system modeling group at Germany’s Karlsruhe Institute of Technology. Cities, states and nations are charting paths to reach nearly net-zero carbon emissions by 2050 or sooner, in large part by adopting low-carbon wind and solar electricity.

But there are two, often unspoken problems with that strategy. First, existing electric grids do not have enough capacity to handle the large amounts of renewable energy needed to put fossil-fueled power plants out of business. Second, backup power plants would still be needed for long stretches of dark or windless weather. Today that backup comes from natural gas, coal and nuclear power plants that grid operators can readily turn up and down to balance sagging and surging renewable supply.

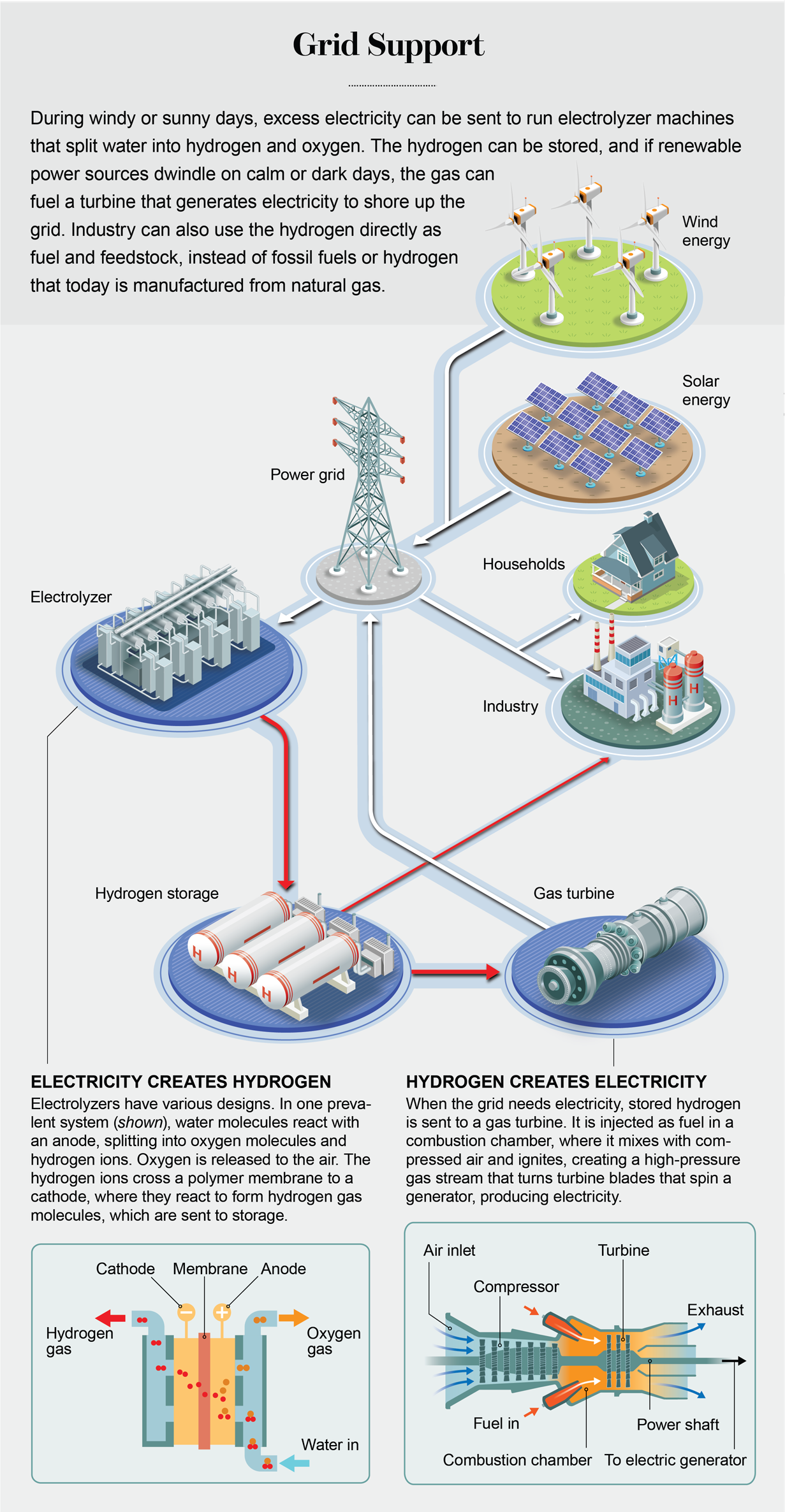

Hydrogen can play the same role, its promoters say. When wind and solar are abundant, electrolyzers can use some of that energy to create hydrogen, which is stored for the literal rainy day. Fuel cells or turbines would then convert the stored hydrogen back into electricity to shore up the grid.

Cutting carbon deeply also means finding replacement fuels for segments of the economy that cannot simply plug into a big electrical outlet, such as heavy transport, as well as replacement feedstocks for chemicals and materials that are now based on petroleum, coal and natural gas. “Far too many people have been misled into believing that electrification is the entire [carbon] solution” that is needed, says Jack Brouwer, an energy expert at the University of California, Irvine, who has been engineering solutions to his region’s dirty air for more than two decades. “And many of our state agencies and legislators have bought in,” without considering how to solve energy storage or to fuel industry, he says.

Can renewable hydrogen make a clean-energy grid workable? And could it be a viable option for industry? Some interesting bets are being made, even without knowing whether hydrogen can scale up quickly and affordably.

DARK DOLDRUMS

The few nations that have bet big on replacing coal and natural gas with solar and wind are already showing signs of strain. Renewable energy provided about 40 percent of Germany’s electricity in 2018, though with huge fluctuation. During certain days, wind and solar generated more than 75 percent of the country’s power; on other days, the share dropped to 15 percent. Grid operators manage such peaks and valleys by adjusting the output from fossil-fuel and nuclear power plants, hydropower reservoirs and big batteries. Wind and solar also increasingly surge beyond what Germany’s congested transmission lines can take, forcing grid operators to turn off some renewable generators, losing out on 1.4 billion euros ($1.5 billion) of energy in 2017 alone.

The bigger issue going forward is how nations will cope after the planned phaseout of fossil-fueled power plants (and, in Germany, also their nuclear plants). How will grid operators keep the lights on during dark and windless periods? Energy modelers in Germany invented a term for such renewable energy droughts: dunkelflauten, or “dark doldrums.” Weather studies indicate that power grids in the U.S. and Germany would have to compensate for dunkelflauten lasting as long as two weeks.

Beefier transmission grids could help combat dunkelflauten by moving electricity across large regions or even continents, sending gobs of power from areas with high winds or bright sun on a given day to distant places that are calm or cloudy. But grid expansion is a slog. Across Germany, adding power lines is years behind schedule, beset by community protests. In the U.S., similar opposition prevents new lines from gaining approval.

To some experts, therefore, dunkelflauten make wind and solar energy look risky. For example, grid simulations done in 2018 by energy modelers at the Massachusetts Institute of Technology project an exponential rise in costs as grids move toward 100 percent renewable energy. That is because they assumed big, expensive batteries would have to be installed and kept charged at all times, even though they might be used only for a few scarce days or even hours a year.

A California-based team of academics reached a similar conclusion in 2018, finding that even with big transmission lines and batteries, solar and wind power could feasibly supply only about 80 percent of U.S. electricity needs. Other power sources will definitely be needed, said team member Ken Caldeira, a climate scientist at the Carnegie Institution for Science, when the study was released.

Certain European experts say the M.I.T. and California studies are too myopic. For several decades European researchers have been zooming out from the power grid to a larger view, considering the full spectrum of energy used in modern society. Pioneered by Roskilde University physicist Bent Sørensen and several Danish protégés, such “integrated energy systems” studies combine simulations for electric grids, natural gas and hydrogen distribution networks, transportation systems, heavy industries and central heating supply.

The models show that coupling those sectors provides operational flexibility, and hydrogen is a powerful way to do that. In this view, a 100 percent renewable electric grid could succeed if hydrogen is used to store energy to cover the dunkelflauten and without the price jump seen in M.I.T.’s projections.

Some U.S. grid studies ruled out hydrogen energy storage because it is costly today. But other modelers say that thinking is flawed. For example, many grid studies being published about a decade ago downplayed solar energy because it was expensive at the time—this was a mistaken assumption, given solar’s dramatic cost decreases ever since. European simulations such as Brown’s take into account anticipated cost reductions when they compute the cheapest ways to eliminate carbon emissions. What emerges is a buildout of electrolyzers that cuts the cost of renewable hydrogen.

In the models, electrolyzers scale up first to replace hydrogen that is manufactured from natural gas, used by chemical plants and oil refineries in various processing steps. Manufacturing “gray” hydrogen (as energy experts call it) releases more than 800 million metric tons of carbon dioxide a year worldwide—as much as the U.K. and Indonesia’s total emissions combined, according to the International Energy Agency. Replacing gray hydrogen with renewable hydrogen shrinks the carbon footprint of hydrogen used by industry. Some hydrogen could also replace natural gas and diesel fuel consumed by heavy trucks, buses and trains. Although fuel cells struggle to compete with batteries for cars, they may be more practical for heavier vehicles; truck developer Nikola Motor Company says the tractor-trailer rigs it is commercializing will travel about 800 to 1,200 kilometers (500 to 750 miles) on a full fuel cell, depending on the various equipment and hauling factors.

Credit: 5W Infographics

Credit: 5W InfographicsIf industry and heavy transport embrace renewable hydrogen, regional hydrogen networks could emerge to distribute it, and they could also supply the carbon-free gas to power plants that back up electricity grids. That is what happens in integrated energy simulations: as more renewable hydrogen is created and consumed, mass-distribution networks develop that store months’ worth of the gas in large tanks or underground caverns, much as natural gas is stored today, at a cost that is cheaper than storing electricity in batteries. “Once you acknowledge that hydrogen is important for the other sectors, you get the long-term storage for the power sector as a sort of by-product,” Brown says.

That perspective comes alive in simulations by Christian Breyer of Finland’s LUT University. In his team’s latest 100 percent renewable energy scenarios, published in 2019 with the Energy Watch Group, an international group of scientists and parliamentarians, power plants burning stored hydrogen fire up to fill the grid’s void during the deepest dunkelflauten. “They are a final resort,” Breyer says. “Without these large turbines, we would not have a stable energy system during certain hours of the year.”

In Breyer’s model, less than half of the wind and solar energy required to make and store hydrogen gets converted back into electricity, a big loss, and the hydrogen turbine generators sit idle for all but a few weeks every year. But the poor efficiency of the hydrogen-to-electricity conversion does not break the bank, because this pathway is used infrequently. Breyer says the scheme is the most economical solution for the energy system writ large, and it is not that different from how many grids use natural gas–fired plants today. “For decades there have been power plants that are switched on only once every few years,” he says.

REPURPOSED PIPELINES

Even though today’s renewable hydrogen generation is meager, Europe is counting on hydrogen to decarbonize its energy systems. The European Commission anticipates renewable energy rising to greater than 80 percent of Europe’s power supply in 2050, supported by more than 50 gigawatts of electrolyzers—the capacity of approximately 50 nuclear power plants. Member states are setting their own goals, too. France is calling for its hydrogen-consuming industries to switch to 10 percent renewable hydrogen by 2022 and 20 to 40 percent by 2027.

These goals will be difficult to reach without policies that encourage entrepreneurial firms to jump-start mass production of electrolyzers. Blending hydrogen into natural gas pipelines is a place to start because it uses existing infrastructure. Engineers had long assumed that molecular hydrogen—the smallest molecule and highly reactive—would degrade or escape from existing natural gas pipes. But recent research shows that blending of up to 20 to 25 percent hydrogen can be done without seeping from or hurting such pipes. European countries permit blending, and firms in Italy, Germany, the U.K., and elsewhere are injecting hydrogen at dozens of sites to help fuel customers’ heaters, cookstoves and other appliances, which do not need alterations as long as the hydrogen content stays below about 25 percent.

Engie has been blending at Cappelle-la-Grande for more than a year without incident or opposition, according to project manager Hélène Pierre. She says that public acceptance is helped by extensive monitoring that shows that homes using the blend have cleaner air; adding hydrogen improves gas combustion in appliances, she notes, trimming levels of pollutants such as carbon monoxide that are created when natural gas burns incompletely.

Europe’s next wave of renewable hydrogen projects could push production to a larger scale. Industrial consortia in France and Germany are seeking financing and authorization for 100-megawatt electrolyzers, 10 times larger than the biggest in operation. Two huge electrolyzer projects are vying for government support to boost a regional hydrogen economy around Lingen, a city in northwestern Germany that is home to a pair of oil refineries. One project that involves a large utility called Enertrag and several of Germany’s biggest energy and engineering firms could provide a blueprint for a nationwide hydrogen network. The project takes advantage of existing gas infrastructure but not via blending. Instead the idea is to repurpose spare gas pipelines to deliver renewable hydrogen to the local refineries, as well as a power plant and even a planned filling station for fuel-cell vehicles. “Our idea is to build up a 100 percent hydrogen gas grid,” says Frank Heunemann, who is managing director at Nowega, one of the partners on the project and the region’s gas-network operator.

Nowega can reuse some empty pipes because the region has two natural gas networks. One carries standard natural gas that is nearly all methane. The other was originally built to deliver local natural gas that was high in hydrogen sulfide, and hydrogen can make some steel pipes brittle. Nowega is phasing out the local gas, leaving empty steel pipes that Heunemann says should be able to endure any reactivity with pure hydrogen. European energy supplier RWE will build the consortium’s main electrolyzer and plans to burn some of the hydrogen output at its Lingen power station. Engineering giant Siemens intends to optimize one of the station’s four gas turbines to handle pure hydrogen.

The consortium is thinking about expansion as well. Lingen is about 48 kilometers from underground salt caverns created to store natural gas. Stocking some of Lingen’s hydrogen, more than 1,000 meters deep in one of the caverns, could be a logical next step, Heunemann says. (Hydrogen is already stored en masse in caverns in Texas and the U.K.)

Nowega also envisions a 3,200-kilometer pipeline network that could reach most of Germany’s steel plants, refineries and chemical producers. The plan centers on repurposing natural gas pipes that were originally built to carry hydrogen-rich “town gas” produced from coal, which was common in Europe until the 1960s. Pipelines that historically coped with 50 percent hydrogen should also be fine “to use for 100 percent hydrogen,” Heunemann says.

THE FUTURE IS TENTATIVE

Europe’s growing interest in renewable hydrogen is not unique. Japan is planning a multidecadal shift to a “hydrogen society” that has been baked into official energy policy since 2014. Meeting one of Japan’s first goals—demonstrating technology to efficiently import hydrogen—is set to begin in 2020 with tanker shipments of gray hydrogen from Brunei, a tiny gas-rich nation nestled in Borneo. Australia’s rival political parties are developing competing plans to export hydrogen to Japan. In December 2019 energy ministers across Australia’s states and territories adopted a national hydrogen strategy, and the national government announced a $370-million (Australian; $252 million U.S.) hydrogen-stimulus package.

Even in the U.S., there are signs of renewed interest. The federal government is once again setting goals for hydrogen technologies, some energy firms are investing and a few states are offering support. Los Angeles may be a leader. “L.A.’s Green New Deal,” unveiled by Mayor Eric Garcetti in April 2019, commits the city to reach 80 percent renewable electricity by 2030 and 100 percent by 2050. The mayor is advancing plans to build solar farms and is also constructing a new natural gas–fired power plant to ensure the city has a backup electricity source. That plant could be converted to burn renewable hydrogen; about 125 kilometers of pipelines already push gray hydrogen to the area’s refineries. And fuel cells are vying with batteries in plans to repower the roughly 16,000 trucks that haul freight at the region’s ports. Fueling those trucks with hydrogen instead of diesel could significantly improve L.A.’s hazy skies.

Brouwer says the entire state needs to think more deeply about energy as it seeks to eliminate carbon emissions. The state may be wasting more than eight terawatt-hours of renewable energy potential every year by 2025, according to projections by Lawrence Berkeley National Laboratory—energy that Brouwer says California should instead be socking away as hydrogen to clean up its refineries and to meet soaring electricity demand during summer heat waves.

Other experts agree that hydrogen can connect those dots. A recent study by the Energy Futures Initiative, a think tank led by former M.I.T. nuclear physicist Ernest Moniz, who was Obama’s second energy secretary, calls on California to tap the “enormous value” offered by renewable hydrogen and other low-carbon fuels. The study concludes that California’s carbon-cutting goals may be impossible to meet without them.

A host of potential problems could still stall or prevent the scale-up of hydrogen infrastructure in California, Europe, and elsewhere. A persistent issue is public anxiety. Hydrogen is extremely flammable, and accidents happen. Last summer a faulty valve caused a hydrogen explosion at a Norwegian filling station for fuel-cell cars. Concrete blast walls minimized injuries, but media reports immediately questioned whether hydrogen energy would survive the incident. In November 2019 California governor Gavin Newsom asked the state’s public utility commission to expedite closure of an underground gas-storage facility, where a four-month leak of natural gas four years earlier had prompted the evacuation of thousands of families.

All energy options have their risks, and community opposition complicates many paths to carbon-free energy. In many places, the public is not enamored with nuclear energy, transmission lines or wind turbines. The cost of electrolyzers may be the biggest challenge facing the renewable hydrogen future, however. To begin replacing gray hydrogen in industry, the cost of producing renewable hydrogen needs to drop from about $4 or more per kilogram today to $2 or less. Several studies indicate that could happen by 2030 if electrolyzer costs continue to fall as they have in the past few years.

The studies also suggest that pattern may not emerge without government incentives. In a recent report, the International Energy Agency notes that hydrogen needs the same kind of government support that fostered early deployments of solar and wind power—industries that now attract more than $100 billion in annual investment worldwide. Those examples, the agency writes, show that “policy and technology innovation have the power to build global clean energy industries.”

Improved technology may be arriving. A new class of electrolyzers is entering the market—solid oxide electrolyzers that produce almost 30 percent more hydrogen than the industry-leading proton-exchange membrane electrolyzers, which Engie is using. Former energy secretary and doubter Chu, now a professor at Stanford University, is working on a novel electrolyzer that relies on tighter spacing of components and other tricks to produce hydrogen faster with less energy. According to Chu, the changes could make “a huge difference in operating cost.” It’s just one more reason, Chu says, why he is warming up to hydrogen.